PG Electroplast Shares Plunge 36% Amid Q1 Profit Drop and FY26 Growth Outlook Cut

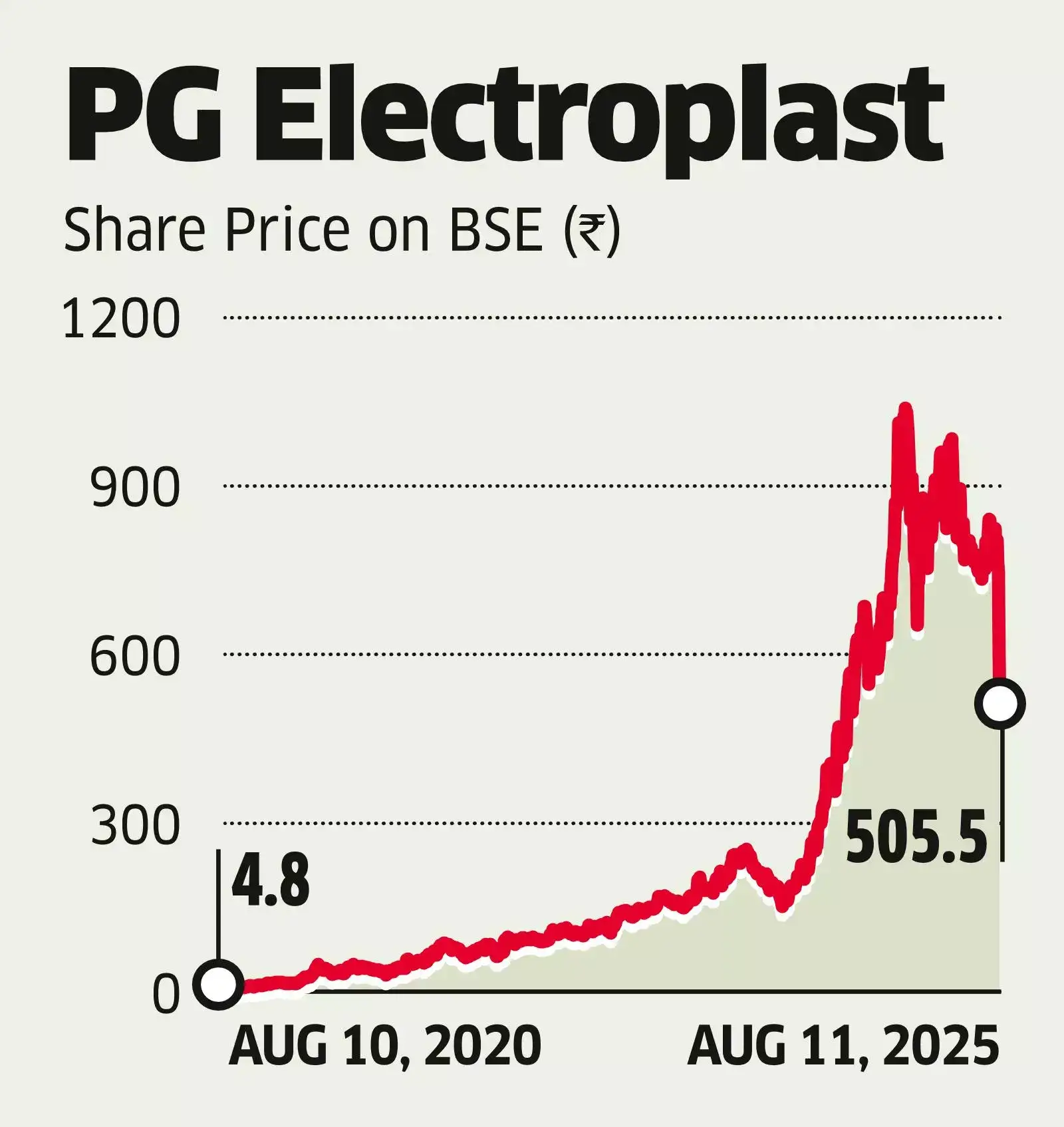

Shares of PG Electroplast Ltd, a prominent player in the consumer durables sector, have experienced a sharp decline recently, falling by approximately 36% over four trading sessions. The decline was triggered by the company’s Q1 fiscal 2026 results and revised growth outlook.

On August 11, 2025, PG Electroplast's share price closed at Rs 506, down about 14% from its previous close of Rs 736.85. Earlier trading sessions saw the stock price fall from a high of Rs 1,054.20 over the past 52 weeks to a low of Rs 414.45. The year-to-date performance shows a steep decline of roughly 48%. The market capitalization stands at Rs 14,337 crore, ranking it 12th within its sector.

This sharp downturn followed the release of quarterly results indicating a 20% decline in net profit, from Rs 83.7 crore in the same quarter last year to Rs 67 crore. Despite a 14% rise in revenue to Rs 1,504 crore, earnings before interest, taxes, depreciation, and amortization (EBITDA) fell by 7.2%, with margins contracting from 9.9% to 8.1%. Analysts attributed the profit drop mainly to softer seasonal demand exacerbated by an early monsoon, impacting the air-conditioner segment strongly.

The stock entered an F&O (Futures and Options) ban recently, indicating that the aggregate open derivatives position surpassed 95%, a threshold that prevents new positions from being formed. This regulatory development is a direct result of the recent heavy selling pressure and price fall.

Brokerages have responded to the Q1 results and projections with mixed but cautious views. While firms like Nuvama have maintained a "buy" rating, they have significantly slashed price targets by up to 35%, reducing the FY26 revenue growth forecast from 30% to 18% and anticipating margin contraction. Meanwhile, Anand Rathi has downgraded the stock. Despite the near-term challenges, analysts note the company’s commitment to long-term revenue targets for fiscal 2028.

The stock price movements also reflect market sentiment: the relative strength index (RSI) dropped to 19.5, indicating that the shares may be oversold. Out of 11 analysts covering PG Electroplast, seven recommend buy, three hold, and one sell, with the consensus 12-month price target around Rs 821, suggesting a potential 64% upside if recovery materializes.

टैग:

स्रोत:

economictimes.indiatimes.com

www.ndtvprofit.com

www.cnbctv18.com

www.businesstoday.in

www.moneycontrol.com