GIFT Nifty Faces Volatility Amid New U.S. Tariffs on Indian Imports

The GIFT Nifty futures market saw significant turbulence following U.S. President Donald Trump's announcement of a 25% tariff on Indian exports starting August 1, 2025. This tariff imposition, along with additional unspecified penalties related to India’s ongoing trade with Russia, has caused a sharp reaction in Indian equity markets, notably impacting the GIFT Nifty futures.

On July 30, 2025, after Trump's announcement, GIFT Nifty futures took a heavy 150-point knock, ahead of the monthly Nifty 50 contracts expiry on July 31. The broader Nifty 50 index struggled to decisively break the 24,900 level, reflecting cautious sentiment among investors. The tariffs and penalties exacerbated concerns about deteriorating U.S.-India trade relations, especially considering the timing coincides closely with the August 1 trade framework rollout.

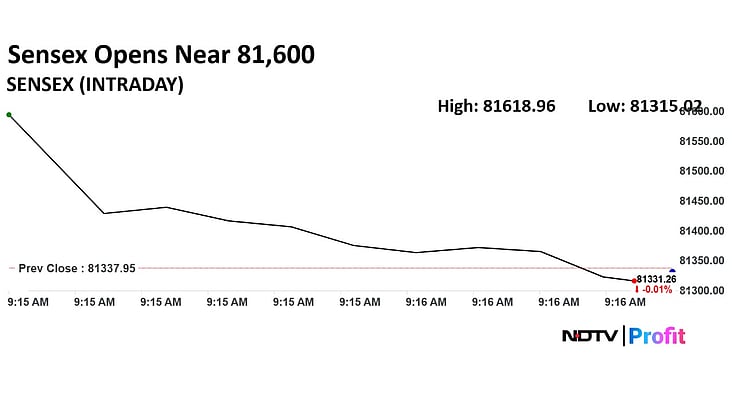

Market sectors such as IT, metal, and realty suffered notable declines, with stocks falling up to 4% amid the shock of the tariff announcement. On July 31, the Sensex fell by 460 points to approximately 81,022, and Nifty dropped 141 points to around 24,714 during early trading sessions. Investor sentiment was dampened by the geopolitical tension caused by the tariffs and the continuing trade ties between India and Russia, particularly in defence and energy sectors.

Despite the negative start, benchmark indices recovered sharply later in the day, with Sensex gaining over 150 points and Nifty rising above 24,900 by early afternoon. Key stocks such as Hindustan Unilever led the recovery, gaining 3 percent intraday following positive quarterly results.

Market experts like Nilesh Shah from Kotak Mahindra AMC anticipate a negative market reaction to the tariff imposition but also advise investors to watch key technical levels and overall market cues during this volatile period.

The situation remains fluid as traders and investors navigate the impact of these geopolitical developments alongside the monthly expiry of Nifty contracts, keeping markets highly sensitive to both domestic and international news flow.

Tags:

Sources:

www.cnbctv18.com

www.news18.com

economictimes.com

www.moneycontrol.com

www.moneycontrol.com